Ghanaians who earn between GHc 10,000 and GHc20,000 have been offered some relief as the government is poised to essentially scrap the 35 percent income tax on earnings above GHc 10,000.

The government will now charge 3o percent on incomes that are over GHc 20,000.

[contextly_sidebar id=”798Hnws0XDNddTRAuMiNpLJ2Gnksnm0Q”]The 2018 midyear budget review introduced an additional personal income tax band of GHc 10,000 and above per month at a rate of 35 percent.

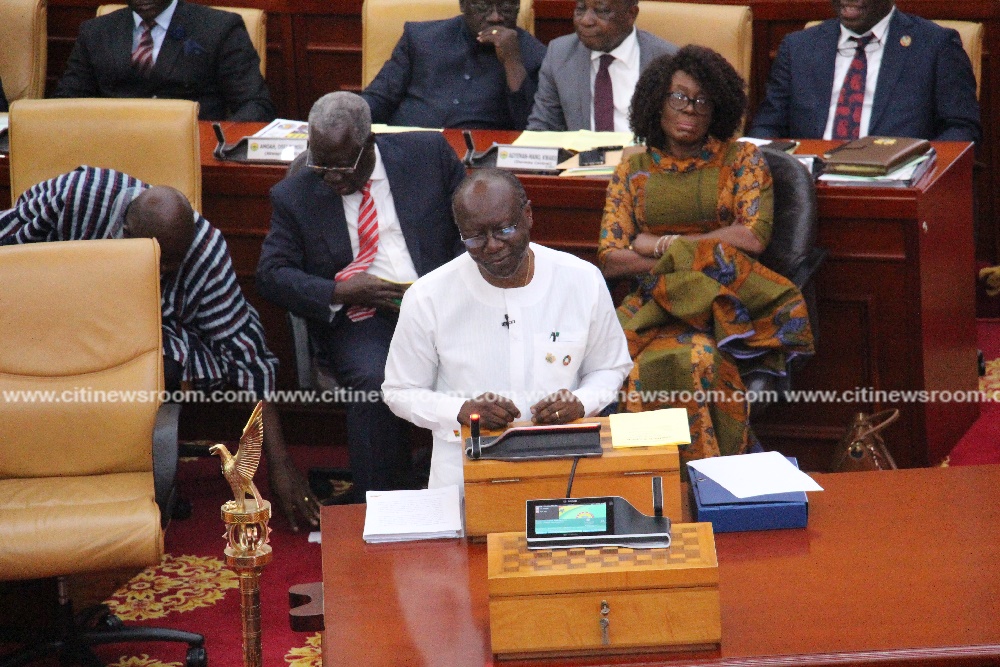

At the time, Finance Minister Ken Ofori-Atta said the new high net-worth income tax was needed to make the rates charged in the country more equitable.

But during the 2019 budget statement, Finance Minister Ken Ofori-Atta said these reliefs were justified following some negative responses to the introduction of that tax.

He said the government had taken into consideration concerns from the public and the Minority in Parliament.

“We have listened to the feedback from across the public and come to the conclusion that some relief from this tax measure is justified,” the minister noted.

“Mr. Speaker, we have listened to feedback from across the aisle and propose to review the band to impact monthly income above GHc20,000, and also at a rate of 30 percent. Mr. Speaker, we will bring the necessary changes to this august house to be legislated.”

This tax was introduced by government as part of measures to raise more revenue to meet its revenue target for the 2018 fiscal year.

The MPs are likely to pass this amendment without any qualms, as it was not well received by some legislators, whose salaries are currently pegged at around GHc 11,000.

For one, the MP for Kumbungu, Ras Mubarak, he expressed his misgivings about the development back in August.

“Our MPs are earning GHC 2,000 less than what they previously earned before the coming into effect of the 35% income tax on people who earn more 10,000. MPs are earning more than GHC10,000. The take-home of MPs was a little over GHC 11,000 . With the coming into effect of the 35% new income tax, MPs are earning around 9,000 plus. For many of us that is a huge dip because it is an assault on our disposable income. Imagine what 2,000 can do in a rural constituency…It is an assault and an attack on the middle class and it will impoverish more people. ”

–

By: Delali Adogla-Bessa | citinewsroom.com | Ghana