In spite of the improvements in Ghana’s economic fundamentals in recent years, and reports of economic growth, the country’s debt per capita continues to rise.

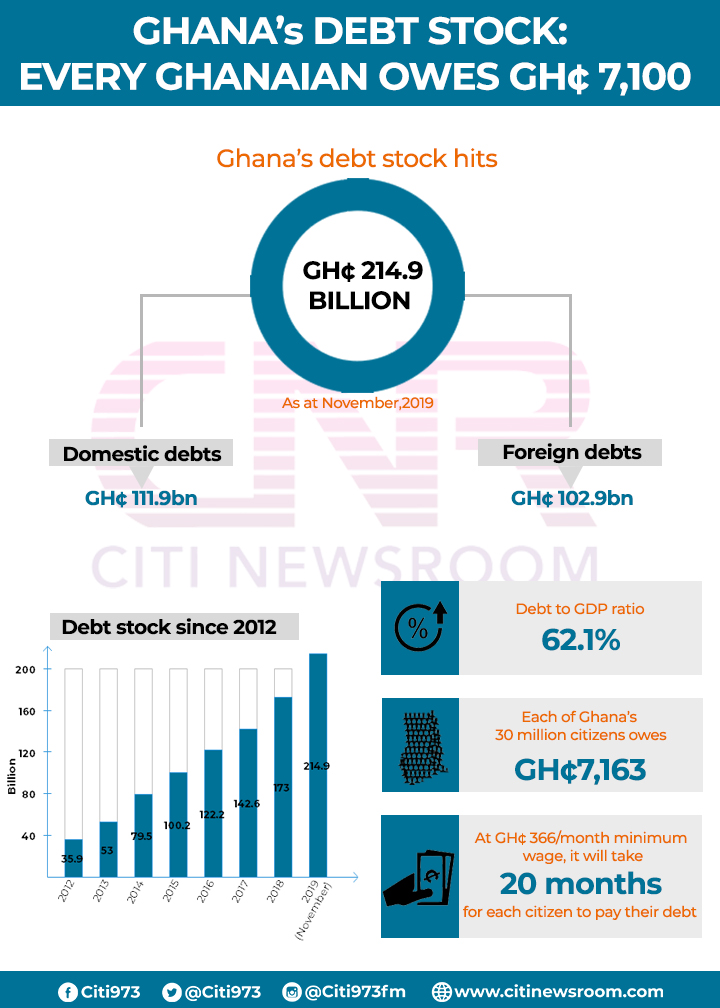

Figures from the Bank of Ghana indicate that the country’s public debt reached GH¢ 214.9 billion as of November 2019.

This equates to about GH¢7,163 each for every Ghanaian man, woman and child.

The debt per capital is calculated by dividing the country’s total debt by the population.

The amount indicates a slight increase from what pertained in September 2019; GH¢6,950.

Compared to GH¢ 1,440 each citizen owed in 2012 where Ghana’s public debt was about GH¢ 36 billion, with a population of about 25 million people, the recent figure announced by the Bank of Ghana is up by nearly 500 percent.

Ghana’s rising debt stock continues to be a source of concern for economic watchers who believe the situation makes the economy more vulnerable to shocks such as commodity price changes on the international market due to dependence on primary commodity exports.

The depreciation of the cedi has also not helped in fixing the issue especially as most of the debt is serviced in foreign currency.

The latest data by the Bank of Ghana represents 62.1 percent of the total value of all goods and services produced in the country.

How long will it take you to pay?

At a daily minimum wage of GH¢11.82, and GH¢366 on average per month, it will take 20 months’ full salary to pay each citizen’s share of the debt.

Who are the creditors?

Out of the GH¢ 214.9 billion, the external debt component reached GH¢111.9 billion with the domestic part accounting for GH¢102.9 billion.

Borrowing more and looming debt crisis

Due to regular instances of misuse of loans in a way that makes it difficult to pay back, there are fears of Ghana being pushed into a debt crisis.

It has often been the case that governments in an attempt to address the country’s economic challenges, tend to borrow more money, much of which would often be used to service debts and cater for recurring costs.

There are many other factors that continue to make Ghana’s worrying debt situation cyclical.

These include overreliance on commodities, unfavourable conditions attached to loans that often widen the poverty gap by pushing for privatization of social services and assets and poor revenue mobilization.

World Bank Country Director Pierre Frank LaPorte earlier in February warned that Ghana could suffer debt crises if it is borrowing irresponsibly.

“Countries especially developing countries have to borrow because most of us do not have adequate resources, we have to borrow to develop, but we have to borrow responsibly. At the moment, Ghana’s debt situation according to World Bank description is a country at a moderate rate to high risk of debt distress; of course, yes, the country has to be careful,” he said.

“The country is at a stage where things are critical. I’m confident the Finance Minister and his team are fully aware of that, we discuss all the time and borrowing as I said is not always a bad thing but you must borrow at the right terms, as best and most favourable as possible and the right amount and the right way,” Mr. LaPorte added.

The World Bank rates Ghana as a moderate to high-risk debt distressed country.

“When we think about debt and borrowing, I want to talk about the fact that we don’t only measure it with respect to GDP. An important metric that we look at and in the case of Ghana is a metric that is of concern, that is, debt service to revenue,” said International Monetary Fund’s Resident Representative, Dr. Albert Touna-Mama.

At a recently held public forum on Ghana’s economy, he averred that the country was in a dire situation with its public debt.

“We use debt service to revenue as a proxy of how sustainable the debt of Ghana is. At the moment, that ratio is close 30 percent. When we take that for countries of similar features, it should be below 18 percent. This is twice as much as what it should be. So, of course, we are concerned about the borrowing of Ghana,” he stated.

Way forward

There has to be a new approach to tackling the country’s debt situation to enable her break free from the increasing dependence on loans.

Stricter fiscal discipline, prudent use of loans and tackling the lapses in the country’s revenue mobilization operations can help improve the situation.

Should this not be done, the next generation will be overburdened with huge debts that will make it highly impossible to commit to any meaningful social or physical development due to the lack of fiscal space.

–

The writer, Jonas Nyabor, is a journalist with Citi FM/Citi TV and citinewsroom.com