The Securities and Exchange Commission (SEC) has announced new capital requirements for operators in its market.

SEC said the revision of the capital requirement falls in line with Section 209 of the Securities Industry Act 2016, (Act 929) which mandates it to undertake such exercises to promote the growth of the industry.

According to a statement from SEC, the new capital requirement takes effect on December 31, 2021.

All new entrants into the market will be required to meet the new capital requirement while those already in the market will be required to meet the new standard before the end of 2021.

“The Director General of the Securities and Exchange Commission, Reverend Daniel Ogbarmey Tetteh speaking at the Annual General Meeting (AGM) of the Ghana Securities Industry Association (GSIA) in Accra remarked that the new minimum capital requirements for market operators were expected to be in force by end of next year therefore existing market operators would be expected to be fully compliant by 31st December 2021 while new entrants would be required to meet the new requirements immediately,” the statement said.

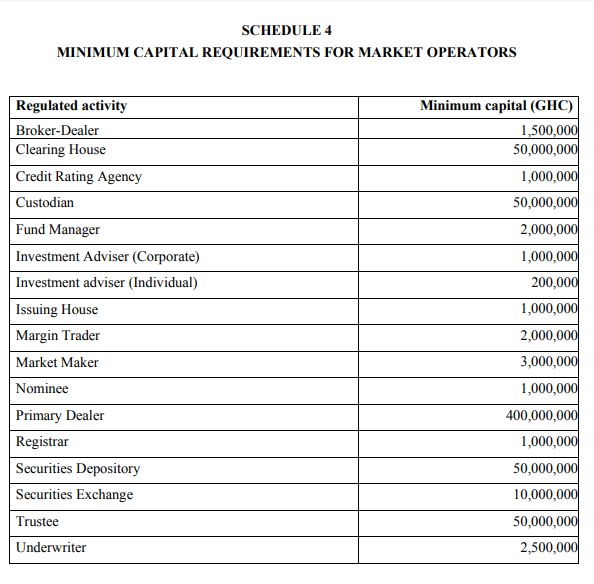

See below are the new requirements:

The statement said extensive stakeholder consultations and discussions were held over the new capital requirement therefore it “should come as no surprise to the market.”

In addition to the new licensing guidelines, the Securities and Exchange Commission has also issued other guidelines to steer the operations and activities of market operators.

These include Conduct of Business Guidelines, Regulatory Sandbox Licensing Guidelines and Corporate Governance Code for listed companies.