The Bank of Ghana has cautioned the public to desist from engaging the services of some 19 unlicensed entities engaged in the provision of loans to consumers.

According to the Central Bank, the operations of the institutions are in contravention of the Banks and Specialised Deposit-Taking Institutions Act, 2016.

A statement, issued by the Central Bank, noted that these illegal entities mostly employ the use of mobile applications and social media in their activities.

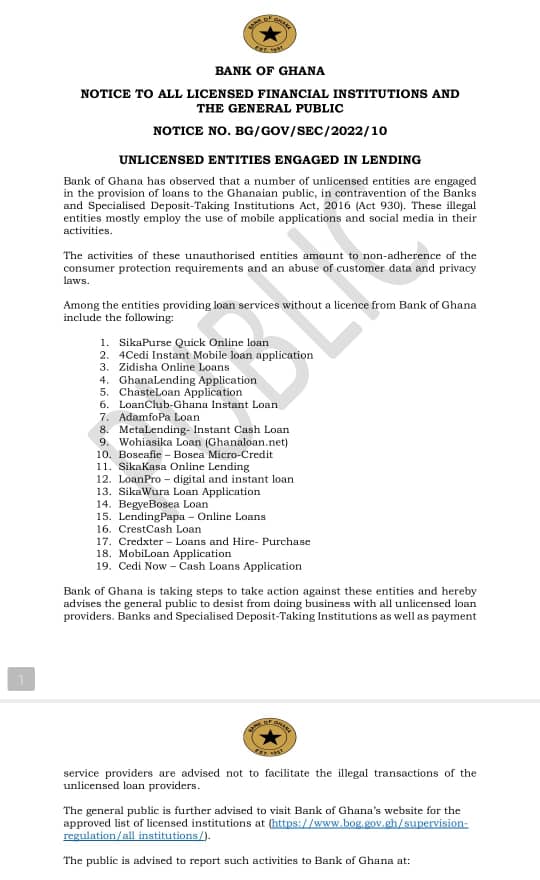

The entities which are 19 in number include SikaPurse Quick Online loan, 4Cedi Instant Mobile loan application, Zidisha Online Loans, Ghana Lending Application, AdamfoPa Loan, CrestCash Loan, MobiLoan Application and Cedi Now – Cash Loans Application.

The Central Bank further stated that, “the activities of these unauthorised entities amount to non-adherence of the consumer protection requirements and an abuse of customers’ data and privacy laws”.

The Bank of Ghana, however, noted that it is taking steps to take action against these entities and thus advised the general public to report such activities.

Banks and Specialized Deposit-Taking Institutions, as well as payment service providers, are advised not to facilitate the illegal transactions of the unlicensed loan providers.

Below is the full statement: