The Ghana Insurers Association has called for the exemption of insurance companies from the domestic debt exchange programme.

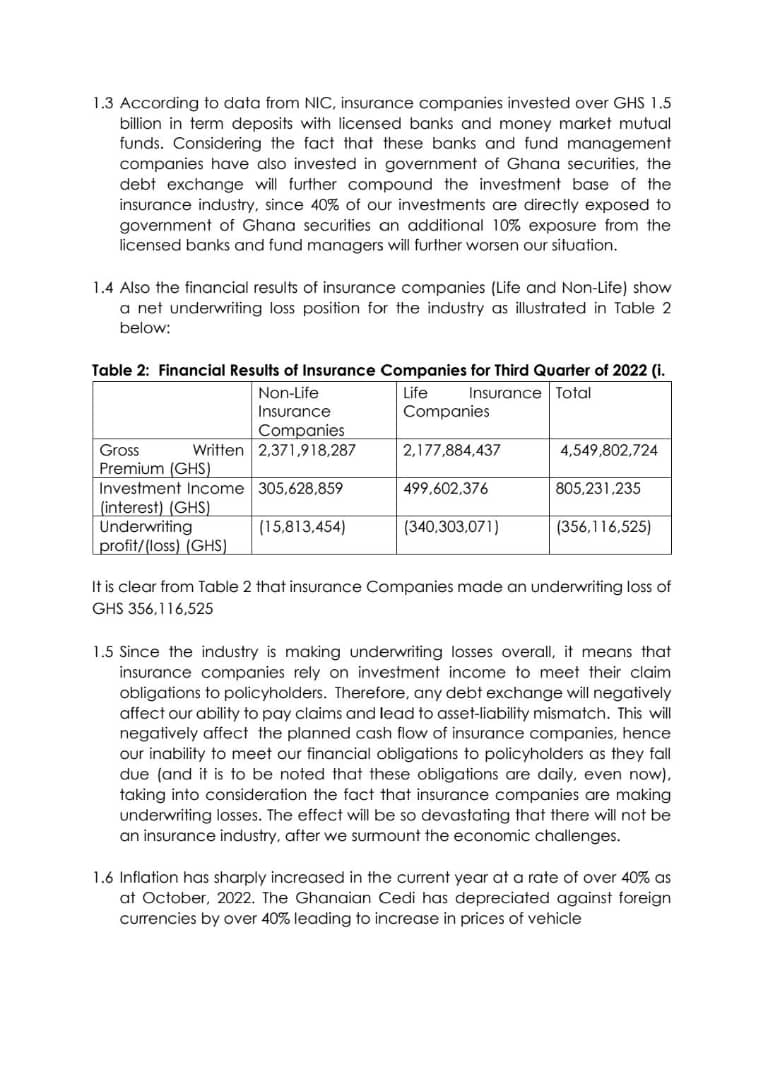

According to the association, 40 percent of its total assets for the third quarter of this year were invested in Government of Ghana Securities.

The association therefore warned that should government go ahead and include insurance companies in the program, there will be a collapse of the industry as its members will not be able to pay the claims of their clients.

Addressing the media at a press briefing, the President of the association, Seth Kobla Akwasi said the insurance industry must be spared.

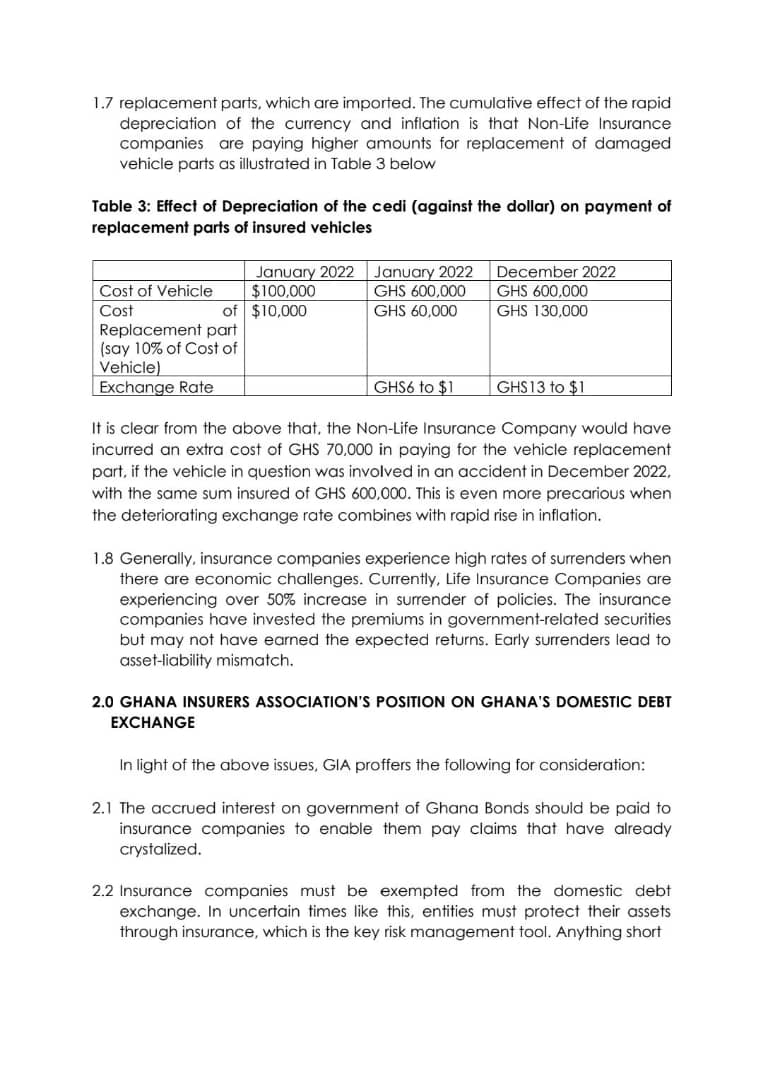

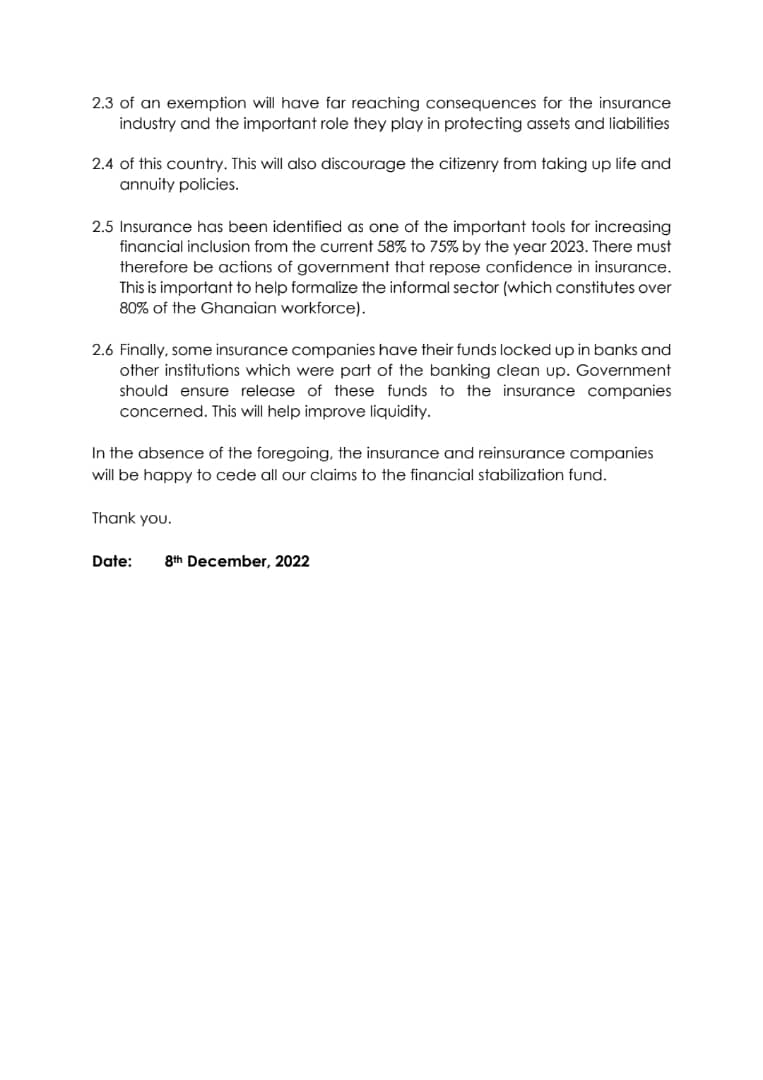

“According to data from NIC, insurance companies invested over GH¢1.5 billion in deposits with licensed banks and money market mutual funds. Considering the fact that these banks and fund management companies have also invested in government of Ghana securities, the debt exchange will further compound the investment base of the insurance industry, since 40% of our investments are directly exposed to government of Ghana securities an additional 10% exposure from the licensed banks and fund managers will further worsen our situation”, he said.

He added that, insurance companies must be exempted from the domestic debt exchange.

“In uncertain times like this, entities must protect their assets through insurance, which is a key risk management tool. Anything short of an exemption will have far-reaching consequences for the insurance industry and the important role they play in protecting assets and liabilities of this country. This will also discourage the citizenry from taking up life and annuity policies”.

“In the absence of the foregoing, the insurance and reinsurance companies will be happy to cede all our claims to the financial stabilization fund.”