The Chamber of Petroleum Consumers (COPEC) says it intends to protest the increase in the Energy Sector Levies (ESLA) which will increase fuel prices.

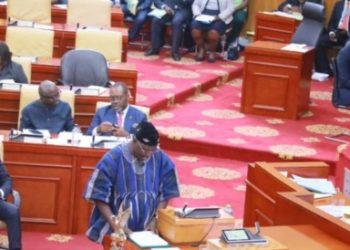

During the mid-year budget review, the Finance Minister said the government had to turn to the ESLA to raise more funds to settle legacy debts inherited from the previous government.

COPEC’s Executive Secretary, Duncan Amoah said the chamber will try to engage MPs before opting for the protest.

Ahead of the budget review, he said he didn’t expect the government to have “increased fuel prices by increasing taxes further.”

“We will resort to some initial dialogue to ensure that whatever he [the Finance Minister] is proposing. Either Members of Parliament will reject it or not allow it to materialise. But if they still insist or push forward, we will not go on a demonstration, we will go on a sleepover.”

Mr. Amoah urged some empathy for drivers he said are already struggling with current fuel prices.

“I know teachers, I know lectures who complain of the high the incidences of fuel prices in the country. I know journalists who meet you and tell you they have packed their vehicles already because they can’t afford to be fueling.”

The Government is proposing to increase the ESLA by GHc 0.20 per litre for petrol and diesel and GHc 0.8 per kg for LPG.

Based on current indicative prices for petrol and diesel this will translate to GHc 0.90 per gallon.

The Government in 2017 issued the ESLA Bond, which has, to date, raised almost GHc 6 billion on the back of ESLA levies to pay for legacy debts from the previous government.

The bond’s proceeds were used to liquidate approximately 60% of the energy sector legacy debts.

Parliament will later today commence the debate on the mid-year budget review and supplementary estimates.

Ghana’s economy is now expected to grow slower than was originally projected in 2019.

The Finance Minister had said the economy would grow by 7.6 percent but on Monday when he presented the 2019 mid-year budget, he said a number of factors have conspired to slow the pace of the economy’s growth.

The economy is now expected to grow at 7.1 percent because of pressures from the poor performance of the local currency against the dollar as well and poor domestic revenue mobilisation.