The Association of Oil Marketing Companies (AOMC) has attributed the latest increases in prices of petroleum products to the prices and forces of demand and supply on the world market.

In a statement to clarify issues on the back of the government’s newly proposed petroleum levies, the OMCs said the upward adjustment of the fuel prices is not a result of the yet to be approved taxes.

“The Association of Oil Marketing Companies would like to state unequivocally that, the current fuel prices on the market are not a reaction to the proposed taxes/levies, but rather the existing world crude oil prices and market forces”, it said.

According to the association, the new levies would only take effect when Parliament approves the 2021 budget.

It added that, while at it, “OMCs will react accordingly, taking into cognizance the effective cost of operations” following the imposition of the taxes.

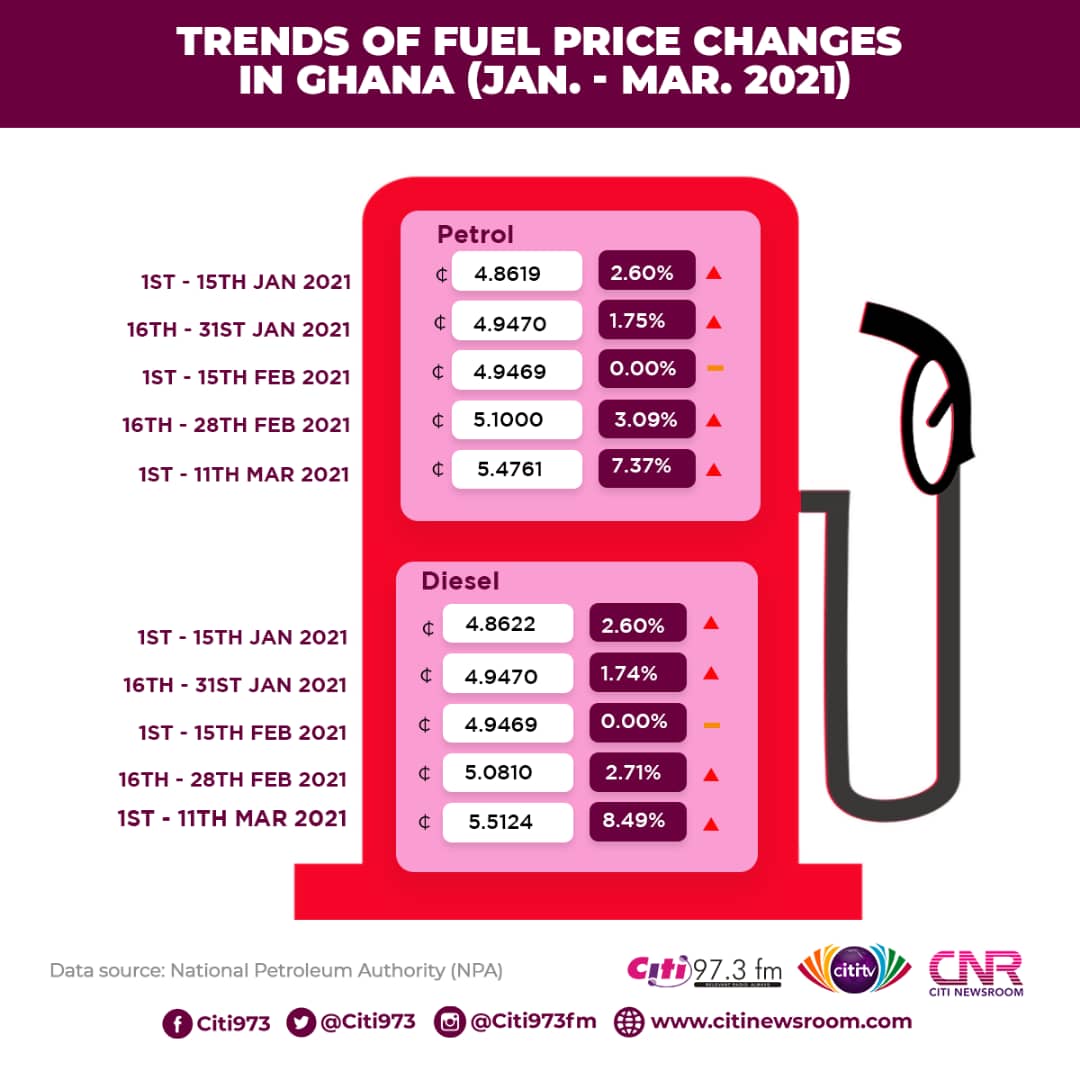

Fuel prices have already risen by some 11% in the last two months and the proposed new taxes could make an additional 5% rise in taxes which will be borne by consumers.

Osei Kyei-Mensah-Bonsu, the Minister for Parliamentary Affairs and caretaker Minister for Finance while delivering the 2021 budget statement in Parliament announced the tax proposals on fuel; 10 pesewas per litre for diesel and petrol as Sanitation and Pollution Levy (SPL) and 20 pesewas per litre of petrol and diesel to be used as Energy Sector Recovery Levy to cover charges on the State for excess capacity of power.

The development has generated huge controversy with many Ghanaians complaining that should the proposed taxes be approved, it will bring untold hardship on them especially as they are yet to recover from the effects of the COVID-19 on their personal economies.

Below is the full statement by the OMCs

We have monitored on the media landscape, the enthusiastic reaction towards a purported increase in petroleum prices at the pump, following the proposed review on taxes/levies, as presented to parliament on Friday, 12th March 2021.

The Association of Oil Marketing Companies (AOMC) would like to state unequivocally that, the current fuel prices on the market are not a reaction to the proposed taxes/levies, but rather the existing world crude oil prices and market forces.

Subsequently, the impact of the proposed taxes/levies would only take effect when parliament has approved the 2021 budget, assented by the President of the Republic of Ghana and duly gazetted.

At the appropriate time, OMCs will react accordingly, taking into cognizance the effective cost of operations.

Nevertheless, the AOMC is grateful to Government under the COVID-19 Support (Section 117), for the introduction of extension of the waiver of interest and penalties, as incentive for early payment of accumulated tax arrears.

However, we would like to propose a review on the condition that, beneficiaries must fulfil the first quarter tax obligation for the year 2021, and also consider the increment of the number of days for payment of petroleum taxes from 21 + 4 days to 40 days, to ensure effective collection of all adduced taxes.

Further, we would like to assure the general public that OMCs/LPGMCs will continue to pursue and uphold consumers’ interests and will always be at their service.