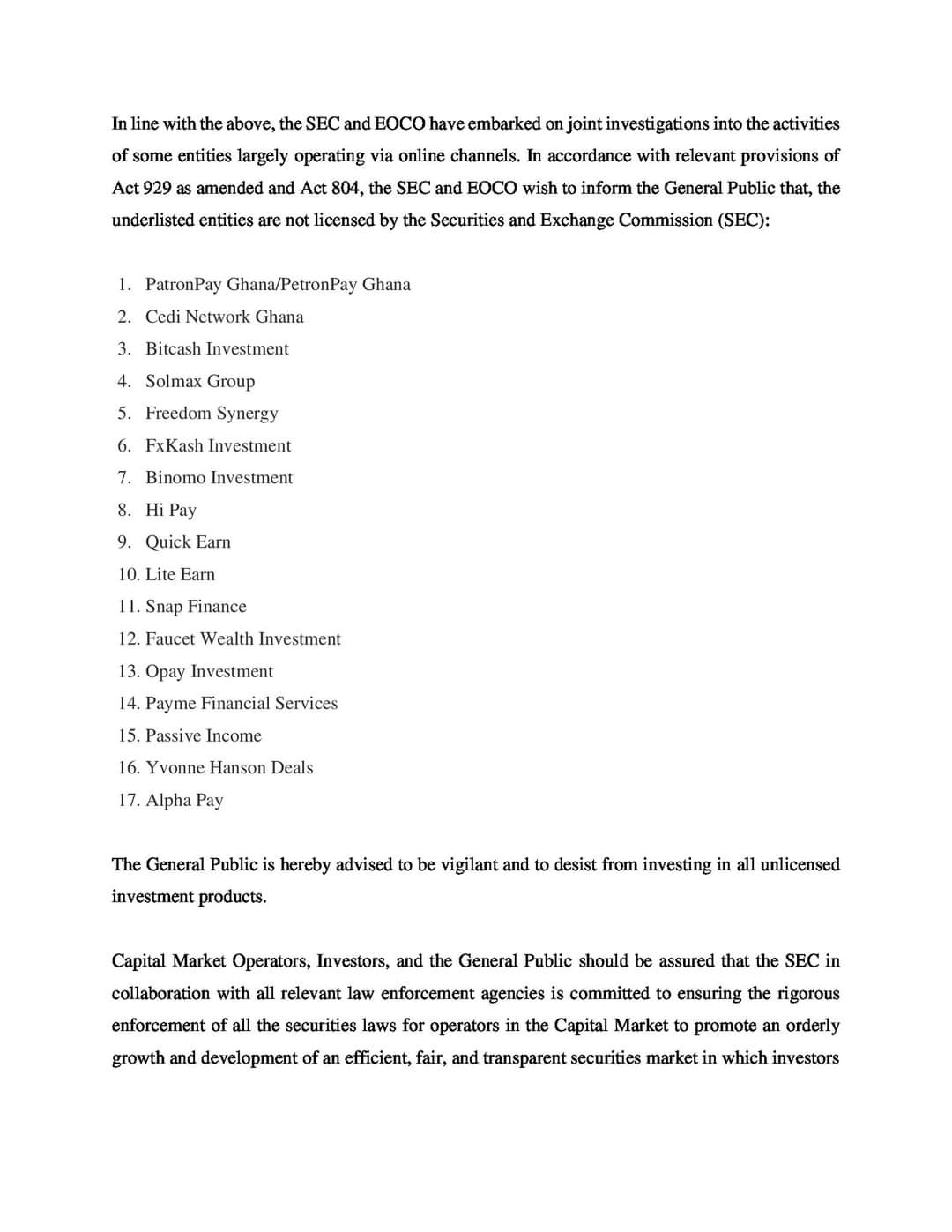

The Securities and Exchange Commission and the Economic and Organised Crime Office have cited 17 investment companies for not being licensed to operate.

The commission in a statement thus urged the public to “be vigilant and to desist from investing in all unlicensed investment products.”

The SEC is the foremost regulatory body of the securities industry, while the Economic and Organised Crime Office is established by the Economic and Organised Crime Office Act, 2010 (Act 804) as a specialised agency to monitor and investigate economic and organised crime.

Section 2(a) of the Economic and Organised Crime Act 2010 (Act 804) gives the Economic and Organised Crime Office the mandate of preventing and detecting Organised Crime.

Furthermore, EOCO under Section 3(d) of Act 804 has a function of taking reasonable measures to prevent the commission of crimes specified in Section 3(a) —financial or economic loss to the Republic or any State entity or institution in which the State has financial interest, money laundering, human trafficking, prohibited cyber activity, tax fraud, and other serious offences.

As part of this mandate, the SEC and EOCO embarked on joint investigations into the activities of some entities, which they said are “largely operating via online channels.”

Find the listed companies in the statement below