Huawei today announced its ‘Non-Stop Banking’ initiative. Unveiled at the Huawei Intelligent Finance Summit for Africa 2023, the initiative calls for hand-in-hand collaboration between the ICT and banking industries and facilitate a digital future of ‘non-stop’ services, ‘non-stop’ development, and ‘non-stop’ innovation.

In a keynote speech announcing the initiative, Leo Chen, president of Huawei Sub-Saharan Africa Region spoke about why going digital has become such a major imperative for the banking industry. Not only does it make it easier for banks to broaden their customer base, he said, it also saves operational costs, allows them to develop new products, and deepen the customer relationship, thus generating revenues for banks.

In Africa, he added, there’s an even greater imperative for banks to embrace digitization, as it allows for greater financial inclusion. While Chen lauded the innovative work done by many African banks in embracing digitization, he pointed out that all players in the industry need to go further if they’re to embrace the ‘non-stop’ approach that will characterise the future of banking.

Huawei has already served more than 2500 financial customers in over 60 countries and regions, including 50 of the world’s top 100 banks. Numerous Huawei technologies, Chen said, are helpful on this front. Over the years, it has provided the foundation and backbone for the digitalization of the banking industry in Africa by supporting the construction of the continent’s ICT infrastructure and digital connectivity in rural areas. Its extensive focus on research and development (R&D), meanwhile, means that it’s well-poised to help the industry shape its future too.

From a technical perspective, he pointed to Huawei’s strength in storage, fibre optic networks, IP networks and data communication, which enable ‘multi-domain collaboration’ solutions for banks. For example, its ‘storage and optical connection coordination (SOCC)’ solutions can reduce system switchover time from two minutes to two seconds after a network breakdown, ensuring zero transaction interruptions. The multilayer ransomware protection (MRP) technology, meanwhile, can provide 6-layer protections, from storage, to network, to applications and other layers. It enables a reliable and secure ‘end-to-end’ protection to the whole system. Finally, Huawei’s intelligent network O&M solutions enable faults to be detected in one minute, diagnosed in three minutes, and rectified in five minutes.

Huawei Cloud, the world’s fastest-growing major cloud service provider, can additionally support the hybrid multi-cloud service required by banks. Huawei’s digital energy solutions, meanwhile, can help to provide an uninterrupted and green power supply for the banking sector. This effectively addresses power deficit issues and supports ‘non-stop’ banking.

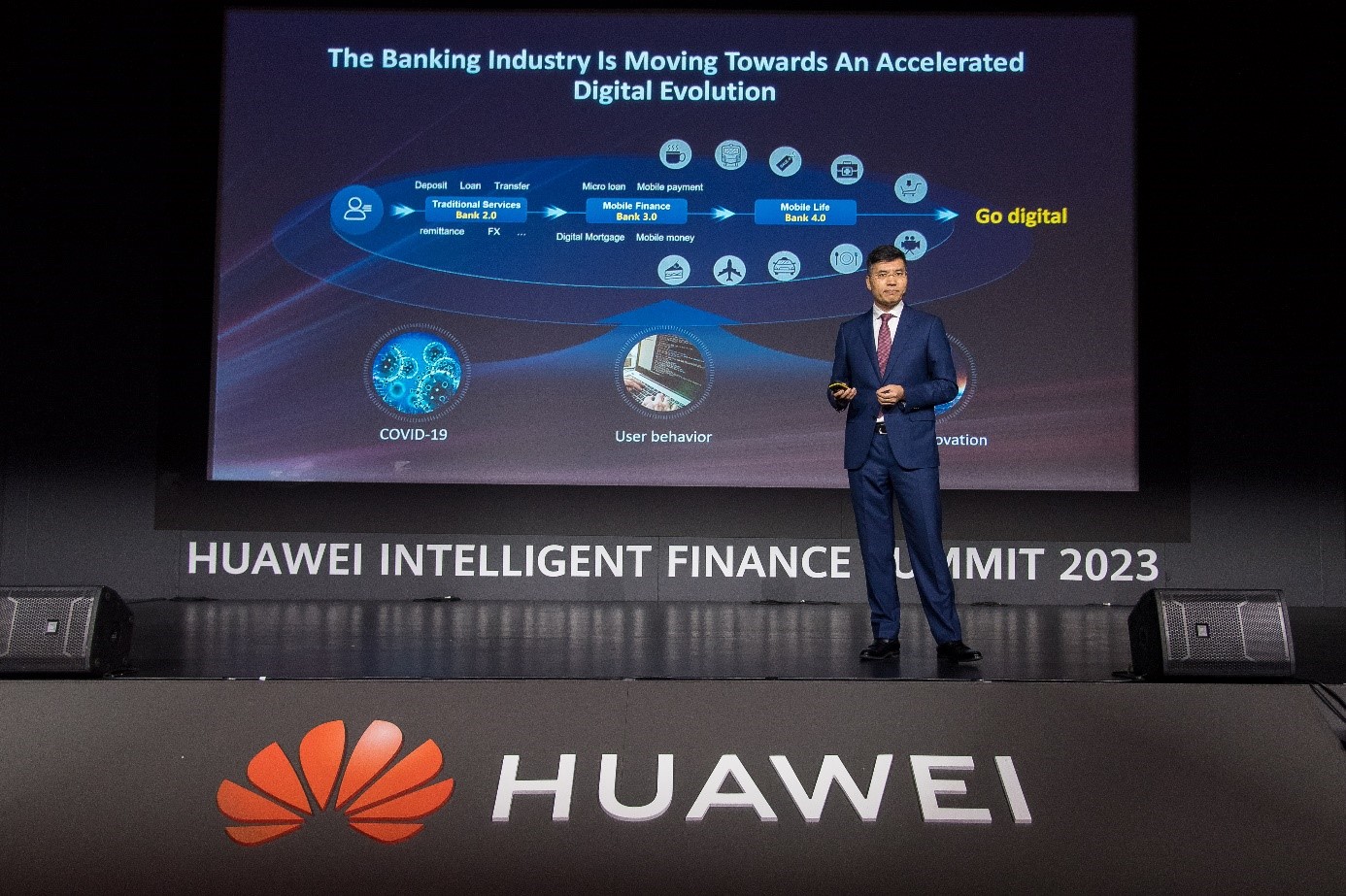

That kind of technological innovation will be important because, as Jason Cao, CEO of Huawei Global Digital Finance pointed out, financial services are becoming mobile and intelligent at a blistering pace.

“The financial industry should pay acute attention to users and their demands, embracing changes,” he said. “Huawei is dedicated to helping its African financial customers address challenges and accelerate changes across six fields: shifting from transaction to digital engagement, cloud-native and agile businesses, data democratization, secure and reliable infrastructure, hybrid multi-cloud and Lego-style modular services, and automated and predictable operation.”

“In this way, Huawei will facilitate financial digitalization and innovatively improve productivity in Africa. Revolving around stability, agility, and intelligence, Huawei aims to build ‘non-stop’ financial services, and achieve ‘non-stop’ development alongside ’non-stop’ innovation,” he added.

Beyond technology, Huawei issued a call for all parties in the industry to come together and build more robust ICT infrastructure, facilitate more measures and policies to encourage digital finance innovation, cultivate a sound innovative ecosystem, and train more digital talent for the industry.

Huawei is particularly active on the last two points. Huawei Cloud’s Spark programme, for example, has pledged to assist 1 000 SMEs over the next three years. And having already trained more than 80 000 digital talents in Africa, it has launched the ‘LEAP’ digital talent training programme in Sub-Saharan Africa region, aiming to train another 100 000 people in the next three years.

The Huawei Intelligent Finance Summit for Africa 2023 brought together more than 200 attendees, including key industry opinion leaders, as well as executives from major banks across Africa.