Ghana’s Housing Situation

In Ghana, the housing deficit is significant. According to the Ghana Statistical Service (GSS), it stood at 2 million units in 2022. This suggests a need for 200,000 units annually over the next ten years, assuming steady population growth and constant supply at prevailing rates.

Home Pricing

Increasing permanent income, graduate education, and a growing expatriate population are some major factors affecting the demand for houses in Ghana. Expatriates inject cash into the economy, increasing the need for modern housing, especially in prime locations and countryside destinations, potentially, pricing out locals. Ghanaians, prior to recent global and national economic challenges, had been enjoying increased financial stability and rising income levels with a general rise in the middle-income class, leading to aspirations for better living spaces and improved living standards. Changing family preferences for smaller sizes deepen also the demand for houses. This rise in demand is transforming the landscape of Ghana’s housing market.

While the pricing of homes varies significantly with factors such as location, size, style, and amenities, typical homes in the country are priced between GHS 200,000 (US$ 16,703) and GHS 800,000 (US$ 66,811) for a standard two-bedroom home. The median price of a 2-bedroom house in Greater Accra and Ashanti Region as of January 2024 stood at GHS 1,034,482 (US$ 86,394) and GHS 230,000 (US$ 19,208) respectively.

Homes in the Greater Accra Region are relatively more expensive than those in the Ashanti Region. The trend is common for other regions as well with even less expensive homes further away from regional capitals. The pricing of homes generally is influenced by demand, additional costs linked to features such as quality of material used, finishing, extra architectural features and miscellaneous development costs contributing to price escalations and explain the variation in pricing across regions in Ghana.

Financing Home Acquisition

Mortgage finance is one typical option for home purchases globally. Mortgages allow for flexible expending on home purchases, spreading payment over a period of ten (10) to twenty-five (25) years. Mortgage interest rates in Ghana range between 20% and 27% on cedi facilities, depending on the lender, the borrower’s source of income, and the loan tenure . In Ghana, the mortgage to GDP ratio of 1% indicates low levels of patronage compared to South Africa, Namibia and Cabo Verde, which have mortgage to GDP ratios between 3% to 10% of GDP. While qualification for mortgage facilities remains a major barrier, the perception of the masses on debt also acts as an inhibiting factor for patronage of mortgages. Majority of home purchase transactions are funded by equity typically through self-development over an extended period or savings in hard currency. Other home purchase options include the rent-to-own programme: a structure for civil servants in Ghana which allows buyers to make monthly payments towards the purchase of a home while living in it for a set period and offered an option to buy at the balance of the outstanding value.

The Affordable Homes Campaign

Affordability is pricing that caters for the masses. As of 2023 in Ghana, there were about nine (9) Affordable Housing Projects (AHP) at various stages of completion including; The Asokore Mampong Affordable Housing Project (Completed) the Borteyman Affordable Housing Project (Completed), the Community 26 Kpone Affordable Housing Project (In-progress), the Saglemi Affordable Housing Project (In-progress), the Amasaman Affordable Housing Project (In-progress), the Shai Hills Affordable Housing Project (In-progress), the Gbetsile Affordable Housing Project (In-progress) and the most recent 8,000 Unit Pokuase Affordable Housing Project. Other private developments seeking to enter AHP space include the Appolonia Bijou Homes Project and Adom City Phases.

The AHPs projects above listed are priced between GHS 159,768.40 (US$ 13,343) for studio units and GHS 492,619.23 (US$ 41,141) for 3-bedroom homes.

Analysis of Affordability Thresholds

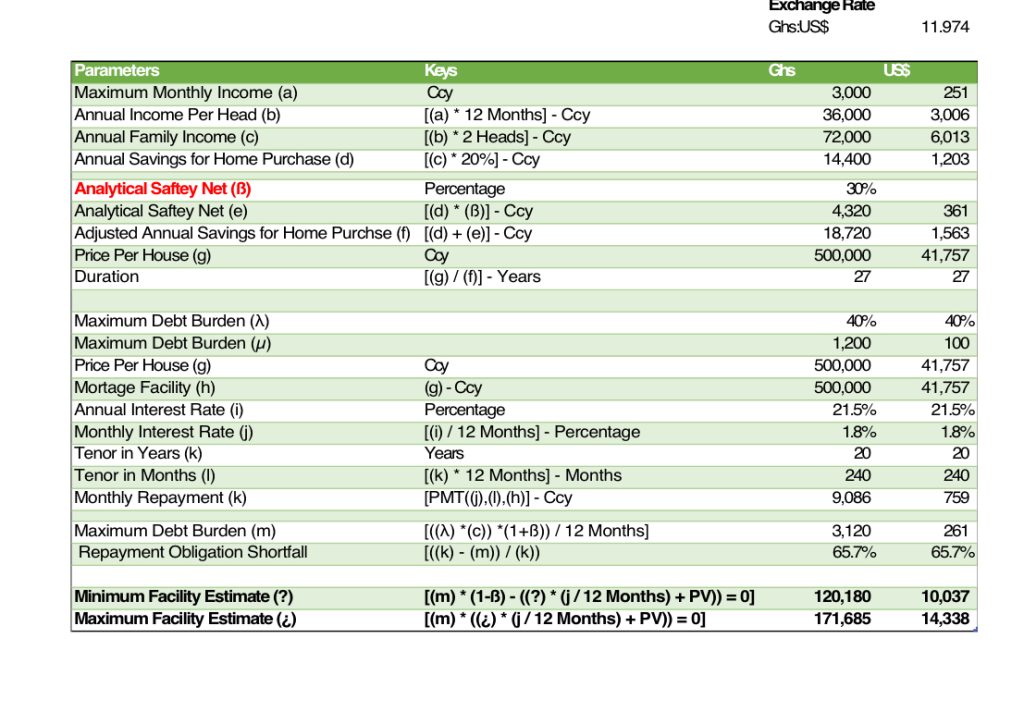

According to the GSS, over 80% of public sector workers earn less than GHS 3,000 (US$ 251) per month as of February 2023. Extrapolating this statistic for the average income of Ghanaians, we will for the purpose of this analysis, peg average earnings from all sources at GHS 3,000 (US$ 251). Affordability of housing is best considered on a household basis, using the average household size of 3.6. According to the United Nations, a household is a small group of persons who share the same living accommodation, pool some or all of their income and wealth, and consume certain types of goods and services collectively, mainly housing and food. Thus, assuming a minimum household of two (husband and wife) in the working class, the average annual household income using the same base individual income of GHS 3,000 (US$ 251) is estimated at GHS 72,000.00 (US$ 6,013) per annum.

For this analysis, we employ the popular 50/30/20 rule indicating that 50% of household income is spent on essential expenses such as rent, utilities, and groceries, 30% caters for non-essential purchases and wants, and 20% put into a savings account. Referencing this general rule of thumb, using GHS 72,000 (US$ 6,013) as the average annual household income, it may be implied that the average household can save at most GHS 1,200 (US$ 100) monthly and GHS 14,400 (1,203) annually towards acquiring a home, assuming all savings are channeled toward home purchase. As an analytical safety net of prudence favoring affordability, we assume a further 30% scale-up of annual savings/ disposable incomes per annum for home purchase to GHS 18,720 (US$ 1,563). Thus, keeping inflation and other price and wage adjustments constant, the total save-up period to purchase a standard 2-bedroom valued at GHS 500,000 (US$ 41,757) is estimated at approximately 27 years through the equity purchase route.

Generally, most lenders prefer a borrower’s mortgage payment be less than or equal to 40% of their gross income. Further to the previous example of a standard 2-bedroom valued at GHS 500,000 (US$ 41,757), a cedi mortgage facility with a tenure of 20 years assuming an average interest rate of 21.5% implies a monthly repayment of GHS 9,086 (US$ 759) per month. Compared to the maximum debt burden of GHS 3,120 (US$ 261), the average household falls short of repayment obligations by 65.7%, rendering them unqualified for mortgage facilities, or overstretched by allocating substantial portions of income towards debt obligations.

For a house to qualify as affordable for the category of citizens, with an annual income of GHS 72,000 (US$ 6,013), given a mortgage tenure of 20 years for cedi-denominated mortgages at an average interest rate of 21.5% the price of the house should fall within the bracket of GHS 120,180 (US$ 10,037) and GHS 171,685 (US$ 14,338). This would be the definition of affordable housing in Ghana.

Way Forward

In light of the concerns raised, questioning the true affordability of affordable housing is important. While commercial institutions in Ghana may not find long-term project investments appealing, the government could consider perpetual mortgages. This would enable extended repayment periods which, coupled with favorable interest rates, reduce financial burdens, making home purchases more feasible. Another option could be exploring affordable renting, providing stable rental prices to investors indefinitely.