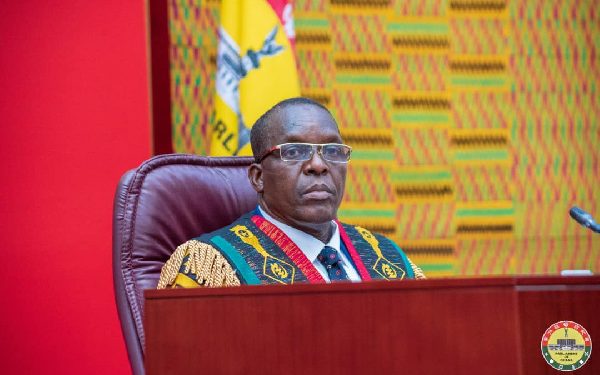

The Speaker of Parliament, Alban Bagbin, has expressed worry about the delay in the work of an ad hoc committee set up to probe the revocation of licenses of financial institutions by the Bank of Ghana in 2017.

The Speaker in March 2021 referred a petition from two businessmen who owned affected banks, Prince Kofi Amoabeng and Dr. Kwabena Duffuor, to a seven-member committee to investigate the circumstances leading to their collapse.

However, the committee is yet to report to Parliament on its findings.

The bi-partisan parliamentary committee probing the matter is being chaired by Joseph Osei-Owusu.

Mr. Bagbin chided the committee for not updating Parliament on its progress.

“The standing orders are clear on that. When the matter is referred to you, and you are unable to report within the period, at least you have to send a report to give the House the reasons why you are unable to report on time. That one, too, they have defaulted.”

The Speaker also criticised the manner in which the financial sector clean-up was carried out.

He believes the government should have supported Ghanaians to succeed.

“I think that our colleagues in government erred in not seeing it that way and rather made sure that the Ghanaians who were trying to enter into the sector lost out.”

“Instead of using about GHS 5 billion to support the banks to survive, we ended up using about GHS 25 billion, but we have not been able to sanitise the sector.”

Background

Former stakeholders of the banks in question, Prince Kofi Amoabeng and Dr. Kwabena Duffuor petitioned Parliament to investigate the conduct of the Bank of Ghana and the Ghana Stock Exchange in the revocation of the licences of UT Bank as well as uniBank and delisting them from the country’s stock exchange.

The petition also sought the restoration of the licences of these banks.

The Speaker of Parliament, Alban Bagbin, subsequently constituted a nine-member committee to look into the petition presented to the House.

This was after the petition was officially brought before him by the Bawku Central legislator, Mahama Ayariga.

Why were the banks collapsed?

Dr. Duffuor, founder of the now-defunct uniBank and Mr. Amoabeng, former Chief Executive Officer of collapsed UT bank, had the licences of their respective financial institutions revoked during the banking sector clean-up which commenced in 2017.

For UT Bank, the apex bank claimed it took the action against the institution because it was insolvent and was unable to recapitalize despite several assurances from the company’s shareholders.

The apex bank also gave similar reasons for the revocation of uniBank’s licence, saying the financial institution was significantly undercapitalised.